All Categories

Featured

Table of Contents

The inquirer stands for a client that was a complainant in a personal injury matter that the inquirer decided on part of this plaintiff. The accuseds insurance company consented to pay the complainant $500,000 in an organized negotiation that requires it to acquire an annuity on which the plaintiff will certainly be noted as the payee.

The life insurance policy company issuing the annuity is a licensed life insurance business in New York State. N.Y. Ins.

annuity contracts,. released by life insurance policy companies, subject to certain constraints, against failing in the efficiency of contractual obligations due to the disability of bankruptcy of the insurance provider providing such. contracts." N.Y. Ins. Regulation 7703 (McKinney 2002) states in the relevant part that" [t] his write-up shall use to.

N.Y. Ins. The Division has reasoned that an annuitant is the possessor of the basic right granted under an annuity contract and stated that ". NY General Guidance Viewpoint 5-1-96; NY General Advice Point Of View 6-2-95.

Best Annuity Plans

The proprietor of the annuity is a Massachusetts firm, the intended beneficiary and payee is a local of New York State. Because the above specified objective of Short article 77, which is to be freely interpreted, is to protect payees of annuity contracts, the payee would be shielded by The Life Insurance Policy Business Warranty Company of New York City.

* An immediate annuity will not have a buildup stage. Variable annuities issued by Protective Life Insurance Policy Business (PLICO) Nashville, TN, in all states except New York and in New York by Protective Life & Annuity Insurance Firm (PLAIC), Birmingham, AL.

What Are Retirement Annuities

Capitalists must carefully take into consideration the investment goals, risks, charges and expenditures of a variable annuity and the underlying investment options before spending. This and other information is contained in the programs for a variable annuity and its hidden investment options. Programs may be gotten by getting in touch with PLICO at 800.265.1545. cost of an annuity. An indexed annuity is not a financial investment in an index, is not a safety and security or stock exchange financial investment and does not take part in any type of supply or equity investments.

The term can be three years, 5 years, 10 years or any number of years in between. A MYGA works by tying up a swelling sum of cash to permit it to accumulate rate of interest.

Annuity Types

If you pick to renew the contract, the rates of interest may vary from the one you had actually initially accepted. One more choice is to transfer the funds right into a different sort of annuity. You can do so without facing a tax charge by utilizing a 1035 exchange. Because rates of interest are established by insurer that market annuities, it is necessary to do your research study before signing a contract.

They can delay their taxes while still utilized and not seeking additional taxed income. Provided the current high rate of interest, MYGA has ended up being a considerable element of retired life monetary planning - annuity fixed term. With the possibility of rate of interest reductions, the fixed-rate nature of MYGA for a set number of years is highly interesting my clients

MYGA rates are typically greater than CD prices, and they are tax deferred which better enhances their return. A contract with more restricting withdrawal stipulations may have greater rates. Many annuity companies deal penalty-free withdrawal provisions that enable you to withdraw some of the cash from an annuity before the abandonment duration finishes without needing to pay costs.

In my opinion, Claims Paying Ability of the service provider is where you base it. You can look at the state guaranty fund if you desire to, yet remember, the annuity mafia is enjoying.

They know that when they place their money in an annuity of any type of type, the company is going to back up the case, and the sector is supervising that as well. Are annuities assured? Yeah, they are. In my point of view, they're risk-free, and you ought to go into them checking out each carrier with self-confidence.

If I put a suggestion in front of you, I'm also placing my license on the line. I'm very positive when I placed something in front of you when we speak on the phone. That does not suggest you have to take it.

Best Fixed Income Annuities

I entirely comprehend that. Bear in mind, we're either weding them or dating them. After that we have the Claims Paying Ability of the provider, the state guaranty fund, and my close friends, that are unidentified, that are circling around with the annuity mafia. How about that for a response? That's a valid answer of someone who's been doing it for an extremely, long time, and that is that somebody? Stan The Annuity Man.

People generally acquire annuities to have a retirement revenue or to develop savings for another purpose. You can purchase an annuity from a licensed life insurance policy representative, insurer, monetary organizer, or broker. You must talk with a financial adviser about your demands and objectives prior to you get an annuity.

Types Of Fixed Annuities

The difference between the 2 is when annuity payments begin. You don't have to pay tax obligations on your earnings, or contributions if your annuity is a specific retired life account (IRA), up until you withdraw the profits.

Deferred and immediate annuities provide a number of alternatives you can pick from. The alternatives offer various levels of potential danger and return: are assured to gain a minimal interest price.

allow you to select between sub accounts that resemble shared funds. You can make much more, however there isn't a guaranteed return. Variable annuities are higher risk due to the fact that there's an opportunity you might shed some or all of your cash. Fixed annuities aren't as dangerous as variable annuities because the financial investment risk is with the insurer, not you.

Low Cost Annuity

If efficiency is low, the insurance provider bears the loss. Set annuities assure a minimal rates of interest, normally in between 1% and 3%. The company may pay a greater rate of interest than the ensured rates of interest. The insurance coverage firm identifies the interest rates, which can transform monthly, quarterly, semiannually, or every year.

Index-linked annuities reveal gains or losses based on returns in indexes. Index-linked annuities are much more complicated than taken care of delayed annuities.

Each counts on the index term, which is when the business calculates the interest and debts it to your annuity. The determines how much of the increase in the index will be made use of to compute the index-linked interest. Various other important features of indexed annuities consist of: Some annuities cover the index-linked passion rate.

The flooring is the minimum index-linked interest price you will make. Not all annuities have a flooring. All fixed annuities have a minimum guaranteed value. Some business utilize the average of an index's worth rather than the value of the index on a defined date. The index averaging might happen at any time during the term of the annuity.

The index-linked interest is included to your initial costs quantity yet doesn't substance during the term. Various other annuities pay substance rate of interest during a term. Compound interest is rate of interest earned accurate you conserved and the rate of interest you make. This indicates that rate of interest already attributed additionally earns rate of interest. In either case, the passion gained in one term is usually intensified in the next.

Why Not To Buy An Annuity

This percent might be utilized as opposed to or in enhancement to an engagement price. If you take out all your money before completion of the term, some annuities will not attribute the index-linked passion. Some annuities may attribute only part of the interest. The percentage vested normally boosts as the term nears completion and is always 100% at the end of the term.

This is since you birth the financial investment risk as opposed to the insurance provider. Your representative or monetary consultant can help you choose whether a variable annuity is appropriate for you. The Securities and Exchange Commission classifies variable annuities as safeties due to the fact that the performance is derived from stocks, bonds, and various other investments.

Fixed Deferred Annuity Rates

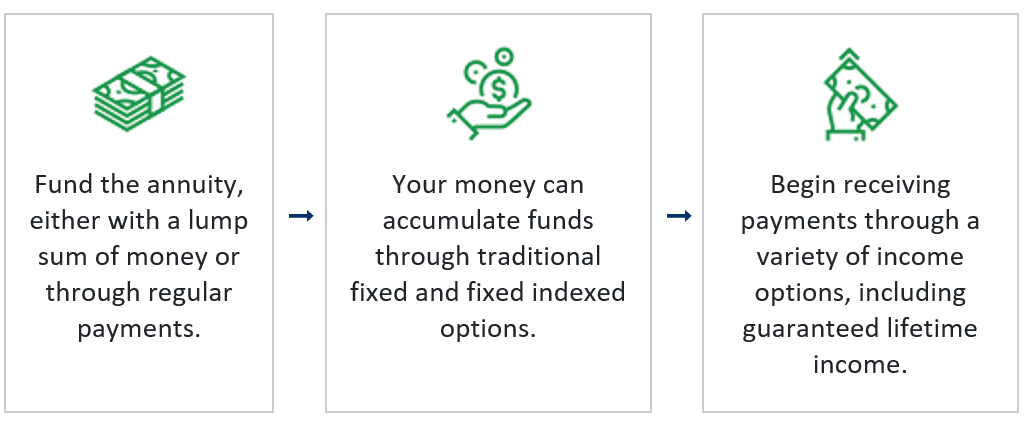

Discover more: Retired life ahead? Assume about your insurance policy. (immediate fixed annuities calculator) An annuity contract has two phases: a build-up stage and a payout phase. Your annuity makes interest during the accumulation phase. You have a number of options on just how you contribute to an annuity, depending upon the annuity you purchase: allow you to choose the time and amount of the settlement.

The Internal Profits Solution (INTERNAL REVENUE SERVICE) controls the taxes of annuities. If you withdraw your earnings prior to age 59, you will possibly have to pay a 10% very early withdrawal charge in enhancement to the tax obligations you owe on the rate of interest earned.

After the accumulation stage finishes, an annuity enters its payout stage. There are a number of choices for obtaining payments from your annuity: Your business pays you a repaired quantity for the time stated in the agreement.

Lots of annuities charge a penalty if you withdraw cash before the payout stage. This charge, called an abandonment fee, is commonly highest in the early years of the annuity. The cost is commonly a percent of the taken out cash, and usually starts at around 10% and drops every year till the abandonment period is over.

Table of Contents

Latest Posts

Decoding How Investment Plans Work A Closer Look at Variable Annuity Vs Fixed Indexed Annuity Breaking Down the Basics of Fixed Annuity Vs Equity-linked Variable Annuity Features of Retirement Income

Exploring the Basics of Retirement Options Key Insights on Tax Benefits Of Fixed Vs Variable Annuities Defining Variable Annuity Vs Fixed Indexed Annuity Advantages and Disadvantages of Fixed Index An

Analyzing Annuity Fixed Vs Variable Key Insights on Fixed Indexed Annuity Vs Market-variable Annuity What Is the Best Retirement Option? Benefits of Fixed Annuity Or Variable Annuity Why Choosing the

More

Latest Posts